Your cart is currently empty!

Understanding the Fine Print: What You Need to Know About CPAP Insurance Coverage

Understanding the Fine Print: What You Need to Know About CPAP Insurance Coverage

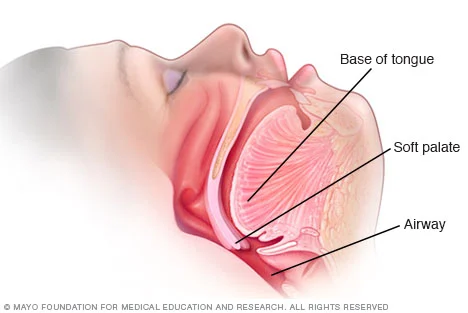

Continuous Positive Airway Pressure (CPAP) machines have become a life-saving treatment for individuals with sleep apnea. These devices work by providing a steady stream of air through a mask, keeping the airway open and allowing for uninterrupted breathing during sleep. However, the cost of CPAP machines and supplies can be a barrier for some individuals, which is where insurance coverage comes in.

CPAP insurance coverage can be a complex and confusing topic, with many factors that can affect coverage and out-of-pocket costs. In this blog post, we will break down the fine print of CPAP insurance coverage and help you understand what you need to know.

1. Types of Insurance Coverage for CPAP

The first step in understanding CPAP insurance coverage is knowing what type of insurance you have. There are three main types of insurance coverage for CPAP: private insurance, Medicare, and Medicaid.

Private insurance, also known as employer-sponsored insurance, is provided by an employer or purchased by an individual. This type of insurance can vary greatly in terms of coverage and out-of-pocket costs, so it’s important to review your specific plan’s details.

Medicare is a federal health insurance program for individuals over the age of 65, as well as those with certain disabilities. Medicare Part B covers CPAP therapy, but it only covers 80% of the cost, leaving the remaining 20% to be paid by the individual.

Medicaid is a state and federal program that provides health insurance to low-income individuals and families. Each state has its own guidelines for CPAP coverage, so it’s important to check with your state’s Medicaid office for specific details.

2. Coverage for CPAP Machines and Supplies

CPAP machines and supplies are typically covered by insurance, but the extent of coverage can vary greatly. Some plans may cover the entire cost, while others may only cover a portion. It’s important to review your plan’s coverage for CPAP machines and supplies to know what to expect in terms of out-of-pocket costs.

Understanding the Fine Print: What You Need to Know About CPAP Insurance Coverage

In general, most insurance plans will cover the cost of a CPAP machine, but may require a copayment or deductible. Supplies such as masks, tubing, and filters may also be covered, but again, the extent of coverage can vary. Some plans may have specific requirements for coverage, such as only covering certain types of masks or requiring a prescription for supplies.

3. Pre-authorization and Documentation Requirements

In order to receive coverage for CPAP machines and supplies, many insurance plans require pre-authorization. This means that you must obtain approval from your insurance company before purchasing or receiving the equipment or supplies. Failure to obtain pre-authorization can result in denial of coverage and leave you responsible for the full cost.

In addition to pre-authorization, many insurance plans also require documentation from your healthcare provider. This can include a prescription for the CPAP machine, a sleep study report, and/or a letter of medical necessity. It’s important to work closely with your healthcare provider to ensure that all necessary documentation is provided to your insurance company for coverage.

4. In-Network vs. Out-of-Network Coverage

Another important factor to consider is whether your insurance plan has in-network or out-of-network coverage for CPAP machines and supplies. In-network providers have negotiated rates with your insurance company, meaning that you will likely have lower out-of-pocket costs. Out-of-network providers do not have these negotiated rates, which can result in higher costs for you.

Before purchasing a CPAP machine or supplies, it’s important to check with your insurance plan to see if they have a preferred provider network and if the vendor you plan to use is in-network.

5. Deductibles, Copayments, and Coinsurance

Like with most medical services, CPAP therapy may require you to pay deductibles, copayments, and/or coinsurance. A deductible is the amount you must pay before your insurance coverage kicks in. Copayments are a fixed amount you pay for each service, while coinsurance is a percentage of the cost that you are responsible for.

It’s important to review your insurance plan to understand your specific costs and what you may be responsible for paying out-of-pocket. This can vary greatly depending on your plan’s coverage and your individual healthcare needs.

In summary, understanding the fine print of CPAP insurance coverage is crucial for managing the costs of this life-saving treatment. Knowing your insurance type, coverage for CPAP machines and supplies, pre-authorization and documentation requirements, in-network vs. out-of-network coverage, and deductibles, copayments, and coinsurance can help you navigate the complex world of CPAP insurance coverage and ensure that you receive the treatment you need.