Your cart is currently empty!

The Connection Between CPAP Insurance Coverage and Improved Quality of Life

Blog Post:

Continuous Positive Airway Pressure (CPAP) therapy is a common treatment for obstructive sleep apnea, a condition that causes pauses in breathing while sleeping. It involves using a CPAP machine that delivers pressurized air through a mask to keep the airway open. This treatment has been proven to significantly improve the quality of life for those suffering from sleep apnea, but it can come at a cost. CPAP machines and supplies can be expensive, and insurance coverage is often necessary to make this treatment accessible for many individuals. In this blog post, we will explore the connection between CPAP insurance coverage and improved quality of life.

The Impact of Sleep Apnea on Quality of Life

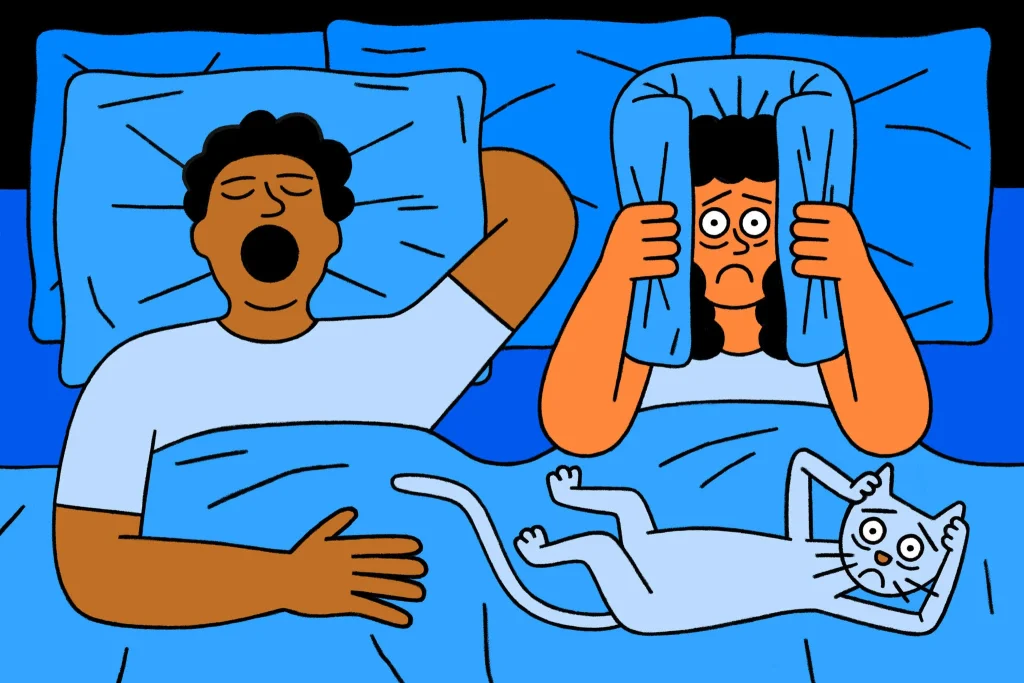

Obstructive sleep apnea is a serious condition that can have a significant impact on one’s quality of life. The repeated pauses in breathing disrupt sleep patterns, leading to daytime fatigue, irritability, and difficulty concentrating. It can also increase the risk of other health problems such as high blood pressure, heart disease, and stroke. Furthermore, the loud snoring associated with sleep apnea can cause strain on relationships and lead to feelings of embarrassment and shame.

The Role of CPAP Therapy

CPAP therapy is the most effective treatment for obstructive sleep apnea. By keeping the airway open, it prevents the pauses in breathing and allows for a restful night’s sleep. This, in turn, leads to improved daytime functioning and a reduced risk of health complications. CPAP therapy has also been shown to decrease the risk of motor vehicle accidents caused by drowsy driving, as well as improve overall mood and quality of life.

The Cost of CPAP Therapy

While CPAP therapy has numerous benefits, it can come at a high cost. A CPAP machine can range from $200 to $1000, and the necessary supplies, such as masks and filters, can add up to an additional $100 or more per month. This cost can be a barrier for many individuals, especially those who do not have insurance coverage.

The Connection Between CPAP Insurance Coverage and Improved Quality of Life

CPAP Insurance Coverage

Fortunately, most insurance plans cover CPAP therapy as a medically necessary treatment for sleep apnea. This includes Medicare, Medicaid, and private insurance plans. However, coverage may vary from plan to plan, and some plans may require a copay or deductible. It is essential to check with your insurance provider to understand your coverage and any out-of-pocket costs.

Improved Quality of Life with CPAP Insurance Coverage

Having access to CPAP therapy through insurance coverage can significantly improve the quality of life for those with sleep apnea. Not only does it alleviate the symptoms of sleep apnea, but it also reduces the risk of other health complications. Additionally, it can lead to increased productivity, improved mood, and better relationships due to better sleep quality and reduced snoring.

The Connection Between CPAP Insurance Coverage and Improved Quality of Life

The link between CPAP insurance coverage and improved quality of life is evident in numerous studies. A study published in the Journal of Clinical Sleep Medicine found that those with insurance coverage for CPAP therapy reported better sleep quality, less daytime sleepiness, and improved mood compared to those without coverage. Another study published in the Journal of Clinical Sleep Medicine showed that individuals with insurance coverage were more likely to adhere to their CPAP treatment, resulting in better health outcomes.

Furthermore, having insurance coverage for CPAP therapy can also reduce the financial burden on individuals and their families. This can lead to a decrease in stress and anxiety, which can have a positive impact on overall well-being.

In summary, CPAP therapy is a highly effective treatment for obstructive sleep apnea, but it can be costly. Insurance coverage for CPAP therapy not only makes this treatment more accessible but also has a significant impact on the quality of life for those with sleep apnea. It reduces the risk of health complications, improves mood and relationships, and decreases financial stress. Therefore, it is crucial to understand and utilize insurance coverage for CPAP therapy to experience its full benefits.

In conclusion, CPAP insurance coverage plays a vital role in improving the quality of life for individuals with sleep apnea. It not only makes this necessary treatment accessible but also leads to better health outcomes and overall well-being. With proper insurance coverage, individuals can experience the full benefits of CPAP therapy and enjoy a restful night’s sleep and improved daytime functioning.